The shortage of semiconductors is now expected to foil the auto industry’s efforts to rebuild inventories through 2022, according to reports from analysts and carmakers.

“Several chip suppliers have been referring to structural problems with demand,” Ola Källenius told reporters during a roundtable event for IAA 2021 auto show in Munich.

“This could influence 2022 and (the situation) may be more relaxed in 2023,” added Källenius, who said the shortages will be reflected in the reduced sales when it reports financial numbers for the third quarter next month.

The point was echoed by Volkswagen CEO Herbert Diess, who told Bloomberg TV, the shortages could persist for months or “even years.”

Suppliers struggling with order backlogs

Meanwhile, Rohm Co., one of the world’s largest suppliers of microchips to the automotive with clients such as Toyota, Ford and Honda, says it will take months to clear its backlog of orders, according to Kelley Blue Book.

“All of our production facilities have been running at their full capacity since September last year, but orders from customers are overwhelming,” Rohm CEO Isao Matsumoto told reporters in a recent interview. “I don’t think we can fulfill all the backlog of orders next year.”

Automakers forced to adjust

Top executives from companies such as General Motors and Ford have said their companies and their dealers are learning to live with inventories well below the 70-day level, prevailing before the COVID-19 pandemic slashed production and by extension the industry’s supply of micro-chips.

GM CEO Mary Barra told analysts last month the company would welcome the opportunity to rebuild inventories.

A new report from the University of Michigan Research Seminar on Quantitative Economics noted, “The global silicon chip shortage continues to squeeze vehicle manufacturers. In February-July, the pace of domestic light vehicle assemblies averaged 8.9 million units, far below the 2020 (fourth quarter average) of 10.5 million.”

The U-M economists noted vehicle demand remained strong, as evidenced by a massive inventory drain and sharp price increases. By July, the days’ worth of dealer supply of new vehicles dipped to the low 20s both for cars as well as trucks versus a pre-pandemic normal in the 60- to 80-day range, they added.

“In the broader economy, many raw materials remain challenging to procure on time, partly because of transportation bottlenecks, exacerbated by a truck driver shortage,” the economists said, adding many manufacturing and service industries report labor shortages, rising wages, and rising prices.

“Until supply chains stabilize, the pressure on producer and consumer prices is likely to continue,” they noted.

Consumers frustrated

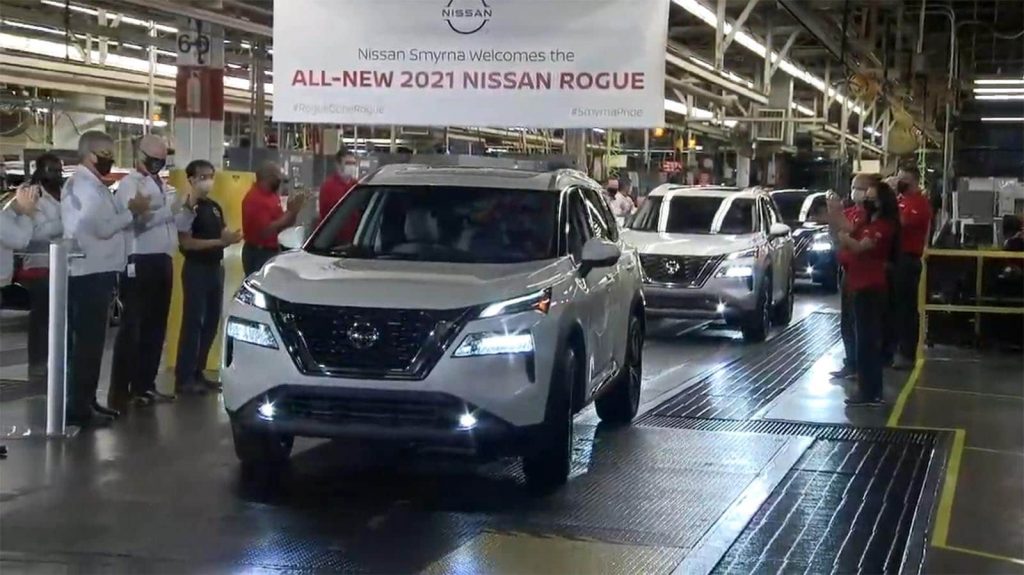

Meanwhile, carmakers are continuing to curb production even as they announce the introduction of new models. Nissan, Toyota, General Motors, Stellantis and Ford have indicated they will continue to cut production well into September.

Consumers also are beginning to feel the pressure. The website Autolist.com notes its surveys indicate 73% of respondents who were shopping for a used vehicle were looking to spend less than $20,000; yet this is the price range that has been hit the hardest by inventory shortages across the used car market.

In addition, 44% of shoppers are changing the timing of their next vehicle purchase due to inventory issues and 40% of respondents said inventory woes are making this car-shopping experience more frustrating than it has been in the past.

Noted Stephanie Brinley, principal analysts with IHS Markit, noted, “The scenario today of low inventory and high demand sees consumers facing higher prices and reduced choice, while automakers see volume decline. There is some automaker benefit in the higher pricing, but as the situation drags on, this may not be enough to truly offset the opportunity lost from reduced inventory. In short, the current situation benefits no one.”

For GREAT deals on a new or used Chevrolet check out Express Chevrolet TODAY!